Sustainability and Airport Finance

(December 2, 2018 by Dafang Wu; PDF Version)

As a financial consultant, I have been cautiously supporting environmental initiatives because many environmentally friendly projects with the current technology have negative financial impacts. On the other hand, I fully embrace sustainability, which is about the survival and improvement of an organization. In the last two decades, the pace of technology adoption seems to have accelerated. When even industry behemoths like Sears and GE can go downhill, each individual airport must consider this question: How can our own organization survive and flourish in the next ten years?

Sustainability

Airport Council International – North America (ACI-NA) adopted a sustainability policy in February 2017, stating that sustainability goes beyond environmental initiatives. The policy identified four cornerstones of sustainability: to improve economic vitality, operational efficiency, natural resource conservation, and social impact (the “EONS”).

While some airports may maintain a position as sustainability leaders, pursuing sustainability is difficult without the direct support of top airport management. That is because sustainability requires coordination from, and the efforts of, many airport departments, though the benefits of sustainability are mostly intangible at the organization level. For example, the finance department may need to evaluate the feasibility of a sustainability effort, provide funding, and manage the impact. Although this may result in a positive organization image, the finance department’s efforts may not be directly recognized. Therefore sustainability must be an organization-wide effort, preferably integrated into the organization’s strategic plan. The ACI-NA policy particularly calls for a cross-discipline task group and a full sustainability committee to coordinate activities among many committees.

Financial planning has two distinct roles in sustainability planning:

- Enabling and encouraging sustainability efforts

- Maintaining and improving a sustainable financial situation

Enabling and Encouraging Sustainability Efforts

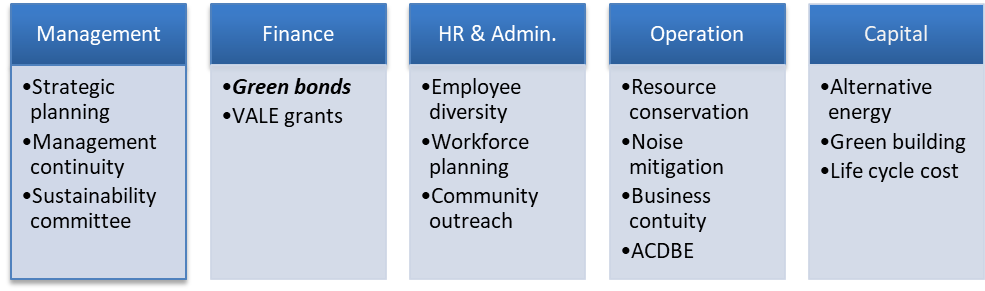

An airport may undertake many efforts to directly promote sustainability, as illustrated below.

Before the airport management allocates management and financial resources to initiate, implement, manage, and monitor those efforts, the management should conduct a financial feasibility evaluation. The top priority of airport financial operations is to meet the payment obligations, including repayment of bond debt service if applicable. When this objective is met, financial planning aims to balance the needs of three secondary objectives: (a) improving the financial situation, (b) undertaking capital projects to accommodate existing and future demand, and (c) maintaining a structure of competitive airline rates and charges.

Financial planning for sustainability efforts must fit into this framework. If a sustainability initiative, such as adopting goals for alternative energy, endangers the airport’s ability to build future terminal buildings for growing traffic needs, this initiative must be re-evaluated. The role of financial planning is to evaluate financial strength, establish policies, and balance potentially conflicting needs.

Encouraging Other Aviation Users

Due to federal rules and regulations, U.S. airports cannot spend funds for non-aviation purposes such as community economic development, other than for very limited exceptions. However, plenty of financial tools are available to encourage other aviation users to support sustainability, such as:

- Encouraging or requiring concessionaires and contractors to take diversity actions or provide prevailing wages

- Including sustainability scoring in rating criteria of requests for proposal

- Reducing percentage fees for concession operations with sustainability efforts, such as rental car operations with hybrid or electric cars

- Reducing parking fees, establishing separate zones, and installing charging stations for green vehicles

When federal regulations do not permit direct involvement, such as providing a free alternative jet fuel blending station, an airport may identify other actions to achieve the same result, such as reducing landing fee rates or providing revenue sharing. Financial planning can help eliminate unrealistic options and identify feasible alternatives.

Maintaining and Improving a Sustainable Financial Situation

A more important role of financial planning is to continue providing funding in the future. As discussed in the State of the Industry presentation, the potential adoption of driverless cars by Transportation Network Companies (TNCs) and peer-to-peer platforms powered by blockchain technology may endanger the two key airport nonairline revenue sources: parking and rental cars. Those two revenue sources accounted for over 25% of U.S. airport revenues in fiscal year 2017, and typically much higher percentages at airports with compensatory ratemaking methodologies. A significant decline in those revenues may endanger the foundation of those airports’ business models.

This potential risk requires the airport financial planner to continue improving the airport’s financial situation by examining the following options:

Evaluating airline rate strategy

If an airport’s existing agreement is near expiration, airport management has a wide range of airline rates and charges methodologies to review. When considering those options for the next agreement period, an airport should revisit its master plan to identify mid-term and long-term capital needs. If a new terminal expansion is needed to accommodate future traffic growth and could result in a doubling of existing airline unit costs, then keeping the current year’s airline payment at the minimum level does not fit the long-term plan. Relying on airline funding of sustainability projects is an uphill battle for any airport management. Building cash reserves and cash-generating ability is the most important sustainability effort from a financial planning perspective.

Building cash-generating ability

One sure way to build a long-term financial advantage is to improve cash-generating ability by charging for amortization. Through this approach, an airport will invest internal cash in airline-related capital projects and recover related investment and imputed interest throughout the useful life. This requires the airport to include the amortization clause in the airline agreement, which all airlines dislike. However, amortizing and recovering cash investment has a snowball effect and can result in a decisive financial advantage over time. Unlike bond debt service that must be repaid annually, the amortization charge can be reduced or deferred if necessary, giving the airport management an additional tool to cope with economic recession. The amortization charge should be on the top of the airline negotiation term sheet, especially if the current level of airline unit cost is relatively low.

Optimizing operating expenses

This presentation discusses the steps to review and optimize operating expenses. The purpose of this effort is not to reduce operating expenses whenever possible to achieve short-term cost saving targets. Instead, an airport should proactively review its cost structure to determine the core activities, the key processes of undertaking those activities, and potential technologies to improve cost-effectiveness.

Evaluating capital spending

The changing operating environment has triggered the need to examine the historical capital planning process. In previous years, building a parking garage may have been considered a necessity because otherwise a parker may have decided to fly from a competitor airport or not to fly at all. This is probably no longer the case after TNCs began providing an economical alternative. Although a new parking garage may still be needed for better customer service, airport management now has the option of evaluating the trade-off between customer service and financial benefits. A similar trade-off exists in the terminal planning process, in which airport management determines the space dedicated to customer amenities, knowing the costs of that space must be paid out of nonairline revenues. In addition to evaluating each project on a case-by-case basis, an airport may start by examining the airline rate strategy as previously discussed, and adopting an internal debt policy to manage financial affordability.

Protecting nonairline revenues

Ensuring proper cost recovery and revenues from each commercial user is a critical step in generating nonairline revenues. Historically, the U.S. airport industry has been able to establish the precedents to charge 10% of gross revenues from off-airport parking and rental car users. This practice should be implemented at each airport to protect the nonairline revenue stream. Many airports have also established a TNC fee based on the recovery of related operating expenses or capital costs, but the related TNC revenues may or may not compensate for the lost parking revenues. Establishing a commercial pricing structure for ground transportation remains a key challenge for airports.