Airport Green Bonds

(December 1, 2018 by Dafang Wu; PDF Version)

Green bonds are bonds that provide funding for environmentally friendly projects. The term “green bond” is evolving and is not defined in federal or tax regulations. The World Bank is an active issuer and provides green bond educational materials such as What Are Green Bonds and annual green bond impact reports.

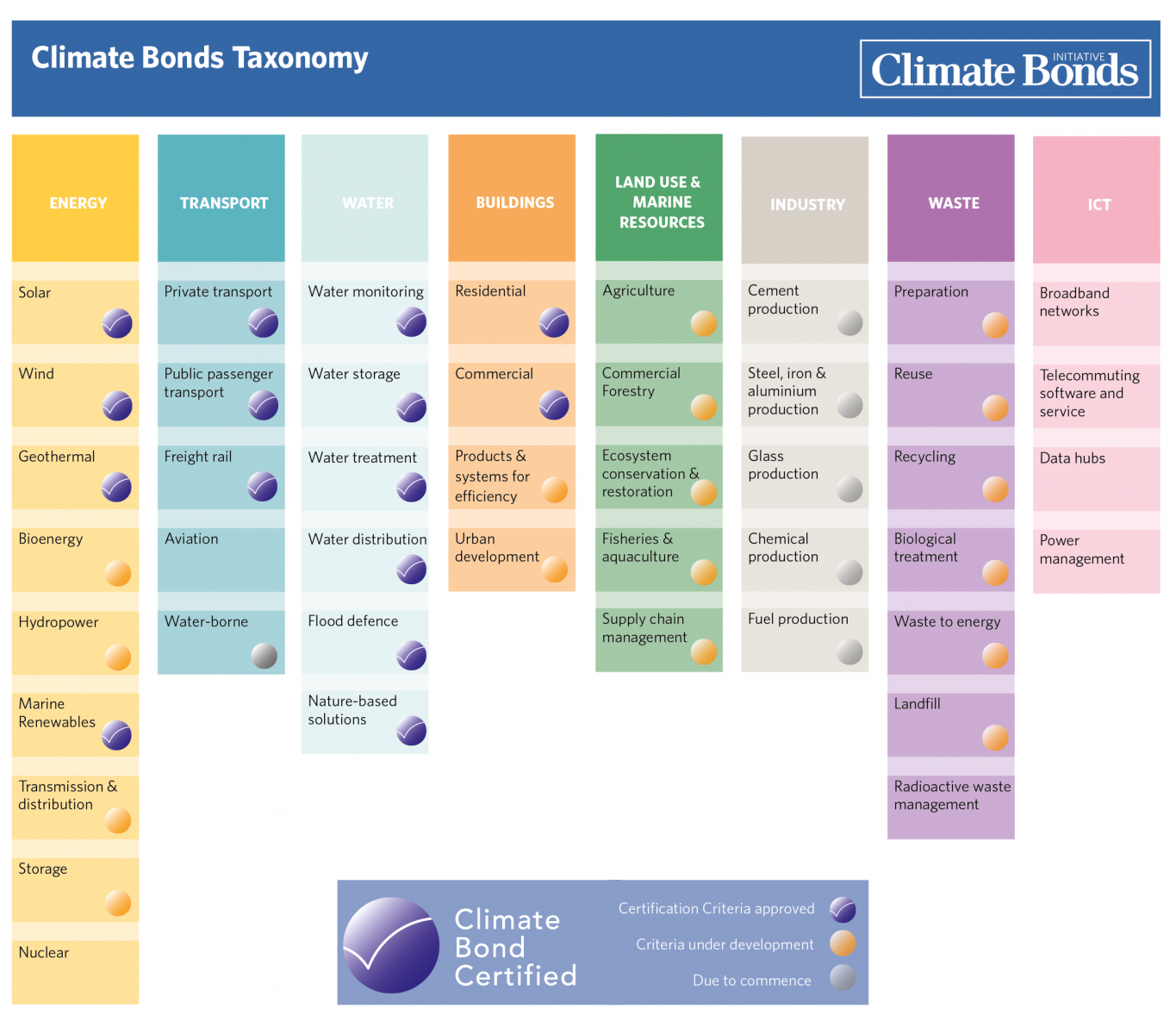

The capital market seems to be embracing the Green Bond Principles (the GBPs) published by the International Capital Market Association (ICMA), which provides voluntary process guidelines. Another non-profit organization, Climate Bond Initiatives (CBI), provides a taxonomy of green bonds and is in the process of designing specific criteria for all types of green bond certifications.

The immediate financial benefits for the airport industry may be limited. However, as a contributing member of the local community, an airport can demonstrate its strong interest in sustainability by issuing green bonds and may establish a long-term pricing advantage. Due to green bonds’ low threshold and the low cost of obtaining certification and validation, airport bond issuers are encouraged to consider issuing bonds as green bonds whenever possible.

ICMA and Green Bond Principles

According to the description at https://www.icmagroup.org, ICMA is a self-regulatory organization and trade association for capital market participants, and has more than 550 members representing the largest investment banks. To create a sustainable global economy, ICMA advocates for green, social, and sustainability bonds and publishes the GBPs, the Social Bond Principles, and the Sustainability Bond Guidelines. The GBPs were initially developed in 2014 and were updated in June 2018. Social bonds provide funding for projects seeking to achieve positive social outcomes such as affordable housing or food security. Sustainability bonds meet the principles of both green bonds and social bonds.

The GBPs include four core components:

- Use of proceeds

- Process for project evaluation and selection

- Management of proceeds

- Reporting

Use of Proceeds

The GBPs define green bonds as bonds that provide funding for Green Projects, including refunding bonds. Eligibility for Green Projects is broad and includes virtually all types of environmentally friendly projects. To the interest of the airport industry, Green Projects include “…green buildings which meet regional, national or internationally recognized standards or certifications.” This means projects with any level of LEED certification will qualify.

Process for Project Evaluation and Selection

The GBPs require that bond issuers provide transparency in terms of their environmental sustainability objectives, selection process, and criteria, and encourage bond issuers to supplement through an external review. As further discussed below, this external review can be achieved through certification such as the CBI certification or a third-party evaluation such as the S&P Green Evaluation.

Management of Proceeds

The GBPs require the bond issuers to segregate the green bond proceeds or at least track them in an appropriate manner. The GBPs also encourage an external third-party review of spending.

Reporting

Reporting is likely a major administrative burden in terms of the issuing of green bonds. The GBPs require the bond issuers to report the use of proceeds at least annually until full allocation, including the list of projects, the project description, and their expected impacts. For many projects, the environmental impact may not be readily available and may incur additional costs to monitor and evaluate.

Climate Bonds Initiative

While the GBPs lay out the principles regarding green bonds issuance, CBI publishes taxonomy and criteria to obtain certification. A certification is not required to issue green bonds; an airport can issue bonds, and claim that those bonds are green bonds without any additional effort. However, a third-party review, verification, or certification improves the transparency of green bond issuance and is beneficial for the long-term health of the green bonds market. The CBI certification process includes 5 steps that mandate an approved verifier.

CBI has already developed certification criteria for over half of the green bond types.

The CBI taxonomy also includes green bonds for low emission buildings. The criteria for this category are more demanding than the requirements in the GBPs. As reported by CBI, a quarter of green bonds are related to low emission buildings. With terminal building costs accounting for majority of airport financing needs and that most terminal buildings can achieve some degree of LEED certification, issuing green bonds for terminal building seems highly possible.

External Review

Many commercial organizations offer external review for green bonds. As a major bond rating agency, Standard and Poor’s also offer Green Evaluation, which may be the most familiar party to the airport industry. The webinar presentation on November 7, 2018 lays out the methodology and approach of S&P’s evaluation process, which includes transparency (15%), governance (25%), and mitigation/adaptation (60%).

Some sample external review files for airport green bonds are listed below:

- S&P Green Evaluation – Two U.S. airports as of November 2018

- CBI Fact Sheet - No airport issue certified as of November 2018

- MCO 2017A Subordinate

- San Francisco Public Utilities Commission, which is a great example of CBI certification and ongoing reporting

Going Green, Sustainably

At the current technology level, going green may have a financial cost. The airport industry needs to carefully evaluate green initiatives, such as establishing goals to achieve certain level of renewable energy consumption or encouraging alternative jet fuel. However, an airport bond issuer can decide to pursue green bond issuance today because it has a minimal downside.

- Immediate financial benefit of issuing green bonds is limited as of today. Although the general public and bond investors are becoming conscious of environmental initiatives, the investors may not be willing to accept a lower yield for green bonds. The size of so-called green bond fund is typically limited.

- Long-term financial benefit may exist. Since bonds are typically 30-year obligations, having a sustainable airport operation is in the best interest of bondholders. Green bond issuance should be part of an airport’s strategy of pursuing sustainability and may establish a long-term pricing advantage.

- Incremental cost is low. If an airport pursues either a certification or 3rd-party review, the incremental costs is insignificant relative to the bond size.

- The strategic value is enormous. Issuing green bonds is a strong indication that the airport is genuine interested in sustainability and is a responsible and environment-conscious member of the local community. The green bond issuance also sends a clear message throughout the organization, and stimulates the organization to pursue other aspects of sustainability. The strategic value far exceeds the incremental costs of obtaining green bond status.