Terminal Space and Ratemaking

(Written by Dafang Wu on March 19, 2016; PDF version)

This article discusses classification of terminal space and options for setting terminal rates and charges methodology.

As discussed in previous articles, an airport operator must collect revenues from both airline tenants and nonairline sources to pay operating expenses, debt service, and other obligations. The airport operator can charge airlines based on bilateral agreements, or establish airline rates and charges unilaterally based on a set of rules set by the Federal Aviation Administration (the FAA). Regardless, as of 2016, most airline rates and charges in the U.S. are on a cost recovery basis. The airport operators allocate all obligations to determine a “rate base” for each cost center, and divide the rate base by an activity level to reach a per-unit rate.

Airline rates and charges in the terminal are typically calculated using square footage as the divisor. For example, if a terminal has one million square feet of rentable space, and an annual rate base of $100 million, the annual rental rate would be $100 per square foot per year. An airport operator faces two issues:

- Determine the total amount to be recovered from the terminal cost center by

- Defining rentable space

- Calculating terminal rental rate

- Determine how the total airline payment is distributed among airlines

- Reviewing space weighting options

- Designing fee structure

Define Rentable Space

Although almost every airport relies on square footage to charge terminal usage, very few airline agreements provide details on how to measure terminal space. Both AUS and SFO airline agreements include a section on space measurement. Airline leased space is typically measured from the centerline of a wall, and other space may be measured from the exterior or interior of the wall.

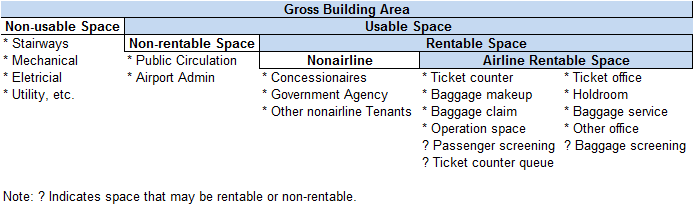

All space in the terminal building is collectively called gross building area or gross terminal area. Gross building area is further divided between non-usable space, such as stairways, mechanical areas, electrical areas, and utility closets, and usable space. Usable space includes public circulation areas, areas occupied by the airport operator, and rentable space.

Rentable space is one of the most important definitions in terminal ratemaking because it is the divisor for the terminal rental rate calculation. The definition varies from airport to airport, but a generally accepted definition is “the total amount of space available for rent in the terminal to airlines, concessions or any other rent-paying tenants as may be adjusted by the airport operator from time to time.” In order to reduce the airline terminal rental rate, some airports include the area occupied by the airport operator in the rentable space. The following figure illustrates different types of space in a typical terminal building:

When an airport operator wants to increase the amount recovered from the terminal, it may add occupied space to the definition of rentable space, such as by adding a passenger screening area, or by excluding vacant space from the definition of rentable space, such as by closing a concourse due to low utilization. On the other hand, if an airport operator wants to reduce the terminal rental rate, it may add non-rentable space to the definition of rentable space, such as the area used by the airport operator for administrative purposes or operation.

Selecting Ratemaking Methodology

In general, an airport operator will first determine an annual rate base for its terminal operations, which may include the following items allocable to the terminal:

- Operating expenses

- Debt service

- Amortization of capital costs funded with internal cash

- Fund deposits, such as a deposit to the operating and maintenance reserve fund

Then the airport operator will negotiate or select a ratemaking methodology, which includes:

- Residual. The airport operator applies all other revenues collected from the terminal as credits to the annual rate base, and divides the remaining requirements by square footage of total rentable space.

- Compensatory. The airport operator divides the annual rate base by the square footage of total usable space or total rentable space. The latter is also referred to as commercial compensatory.

- Other. The airport operator may negotiate with the airlines and set a fixed dollar amount as the terminal rental rate.

The airport operator may also adopt a hybrid approach: either apply more credits, such as parking revenues, to the residual approach, or voluntarily apply more credits, such as a portion of terminal concession revenues, to the compensatory approach. Such variation does not change the underlying risks:

- Under a residual approach, the airport operator has no vacancy risk. A residual approach can be adopted only through bilateral agreements.

- The airport operator can impose a compensatory approach and bear all the vacancy risks.

- The airport can impose a fixed dollar amount as the terminal rental rate if it can demonstrate that the charged rate is lower than the rate calculated under the compensatory approach.

After the airport operator selects one ratemaking methodology, the total airline payment would equal the product of (a) average terminal rental rate, and (b) square footage of total airline rented space.

Space Weighting

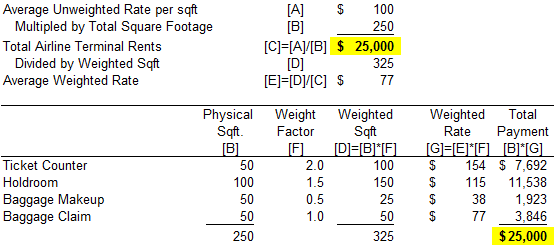

The condition of different types of airline rentable space varies significantly, from a well-furnished air-conditioned ticket counter to a baggage makeup area without air conditioning. Therefore, many airports assign a space weighting factor to each class of terminal space in order to properly allocate the total payments. The following table illustrates the allocation process:

Total airline payments must remain the same before and after the space weighting. The ticket counter typically has the highest weight factor. The baggage makeup area, related tug drive area, and unenclosed space typically have the lowest weight factors.

Assigning the value for each weight factor is arbitrary. Therefore, most airports implementing rates and charges unilaterally use equalized terminal rental rates regardless of space types.

This link provides current terminal rental rates at U.S. large-hub airports. However, because of the difference in the definition of rentable space and in space weighting, the rental rates are not comparable.

Designing a Fee Structure

The airlines use terminal space in different ways, triggering the need to further allocate the total payments or to design additional fees.

- Shared/Joint/Common use space is space used by two or more airlines.

- Preferential space is under the airport operator’s control, where an airline has priority to use over all other airlines, as detailed in each agreement.

- Exclusive space is under an airline’s direct control. No other airlines have access to an airline’s exclusive space.

- Common use space can be used only by one airline at a time, such as a ticket counter used in the morning by airline A, and used in the afternoon by Airline B.

- Joint use space can be used by two or more airlines at the same time, such as a baggage claim area distributing bags for airline A on carousel A and for airline B on carousel B.

- In many documents, those terms are used interchangeably. The rest of this article uses “shared use” to refer to both terms.

An airport operator charges for exclusive space and preferential space by square footage. For shared use space, an airport operator may allocate the total requirement to each airline, or calculate a fee based on unit of activities. For example, for a baggage claim area with 100,000 square feet and a terminal rental rate of $100 per square foot per year, an airport operator may recover the total requirement of $10 million by:

- Shared-use formula. The traditional approach is to allocate 20 percent of the total requirement to each airline, based on the total number of airlines, and to allocate the remaining 80 percent based on enplaned passengers. The formula has since been revised to 90/10 or 100/0 at some airports to accommodate the airlines with low activity level, such as an airline operating only one weekly flight. Some shared-use formulas take into consideration other activities, such as aircraft operations, deplaned passengers, bags processed, seats, and international arriving passengers, among other activities. For some airports using the 80/20 formula, the airport operators may exclude a small carrier with less than x percent of total airport enplaned passengers from the allocation of the fixed costs of 20 percent.

- User fee. Instead of allocating the total requirements and sending each airline an invoice, an airport operator may set a per-user fee. For example, if the number of total arriving passengers, excluding users of the Federal Inspection Service, is expected to be 2 million, the airport operator may publish a baggage claim rate of $5 per user and require each airline to self-report.

Evolvement of Per-Turn Fee

A per-turn fee in this section refers specifically to the airline payment for each aircraft departure from a common-use gate at an airport. The increasing demand of establishing a per-turn fee is due to expansion of ultra-low-cost carriers (ULCCs), which may operate only one weekly flight at an airport. If the ULCC must rent a holdroom on a preferential basis, the per-unit cost will be prohibitive. As most airports are hard-pressed to seek additional air service, establishing a per-turn fee is becoming the norm. A per-turn fee could result in a lower cost per enplaned passenger for the ULCCs than for the network carriers when an airport operator uses the number of turns as a divisor to recover related costs. That is because the ULCCs typically use narrow-body jets with 150 seats, compared to the network carriers that may use regional jets of 50 seats.

The per-turn fee rate is typically included in the annual rates and charges schedule published by each airport, and may include different rates for different types of aircraft. The per-turn fee rate is usually not comparable across airports because the per-turn fee rate may cover some or all of the following components:

- Ticket counter

- Airline ticket office

- Baggage makeup

- Baggage claim

- Holdroom

- Jet bridge

- Other miscellaneous fees, but typically not including landing fees

The network carriers began to pay attention to this issue in 2013. Airlines for America (A4A), representing a majority of U.S. carriers in 2014, submitted a letter to the FAA in December 2014. Instead of accusing any specific airport, A4A raised many theoretical questions related to the per-turn fee, such as “Does the Policy permit a rate methodology that charges air carriers different rates based solely on the number of their scheduled daily departures?” After a comprehensive review, the FAA provided a response in February 2016; it reiterated principles of its rates and charges policy, but declined to offer an opinion without a factual background.

The per-turn fee issue posed an interesting moral question to each airport operator. The network carriers typically provide a majority of air service at an airport, and, when operating under a residual ratemaking methodology, commit to pay whatever necessary for the airport to meet all payment obligations. Therefore, the network carriers can be considered the best and most loyal customers of an airport. On the other hand, ULCCs typically operate as non-signatory airlines, have no residual payment obligations, and sometimes cancel a route immediately when they cannot generate adequate profits. Creating a fee structure that results in a lower per-passenger cost for the ULCCs, although it may be legal and reasonable, may not reflect the value each airline contributes to an airport.

Nevertheless, each airport, especially small airports suffering from stagnant or even declining air traffic, has been trying its best to secure additional air service, including through active route marketing, adopting an air service incentive program, and establishing a per-turn fee, among other actions. The per-turn fee methodology will remain a key issue in airline negotiations for years to come.