Cost per Enplaned Passenger

(March 15, 2015 by Dafang Wu, updated; PDF Version)

This article discusses sources of cost per enplaned passenger (CPE), calculation of CPE, uses of CPE in airport finance, and current and potential efforts to supplement CPE with other financial metrics. CPE data in this article are extracted from a database updated from time to time.

Cost per enplaned passenger, or CPE, is the average passenger airline payments per enplaned passenger at a given airport. A majority of U.S. airports provide CPE data, which is considered a key metric to evaluate the financial operations. As discussed below, CPE provides only partial information about the financial operations of an airport and must be considered in combination with other metrics.

Finding CPE Data

U.S. airports report CPEs in multiple documents and to multiple agencies and associations. It is not uncommon to see an airport reporting different CPE numbers for the same fiscal year. Typically, CPE for an airport can be found in one of the following documents:

- Audited financial statements. Although there is no mandated reporting of CPE in audited financial statements, many airports include the current fiscal year's CPE in the management discussion or the statistics section. Most recent audited financial statements are available on this site (Large Hub and Medium Hub).

- Bond official statements. When issuing revenue bonds, U.S. airports are sometimes required to engage an airport consultant in evaluating airport financial operations. All of those consultant reports include discussions of CPEs unless the bond is paid from a single revenue source such as Passenger Facility Chage revenues, instead of from airport revenues. Those official statements can be found at emma.msrb.org, or on this site (Large Hub and Medium Hub).

- Bond rating agency reports. In order to sell airport revenue bonds, U.S. airports typically request bond ratings from the rating agencies and provide a large amount of data to the rating agencies in this process, including CPEs. Bond rating provides a quick and easy-to-understand way for general investors to evaluate risks.

- FAA Form 5100-127. Starting in fiscal year 2009, the Federal Aviation Administration (the FAA) revised the layout of Form 5100-127, and requires all reporting U.S. airports to include a calculation of CPE in their reporting. Those CPEs are calculated using accounting data without allowing any specific modification, and thus provide an interesting comparison to CPEs reported by U.S. airports in other documents. Form 5100-127 data can be found from the FAA site, or this page.

- Operating budget, news articles and other sources. CPEs found from other sources tend to be less reliable. Industry associations such as ACI-NA may require member airports to respond to annual surveys, including CPE data. However, the survey results are typically not available for the general public.

The following table summarizes the CPEs of large hubs. CPEs for medium-hub and small-hub airports can be found under different sections, and are being updated from time to time.

[moduleplant id="87" table_caption="CPE Summary" source_sql_connection="joomla" source_sql_query="Select Airport, CurrentCPE, CurrentCPEYear as Year, CurrentCPESource as Source, FutureCPE, FutureCPEYear as Year2, FutureCPESource as Source2 from AirportInfo where hubsize='l'"]

{aridatatables moduleId="94"}

Examining CPE Variance

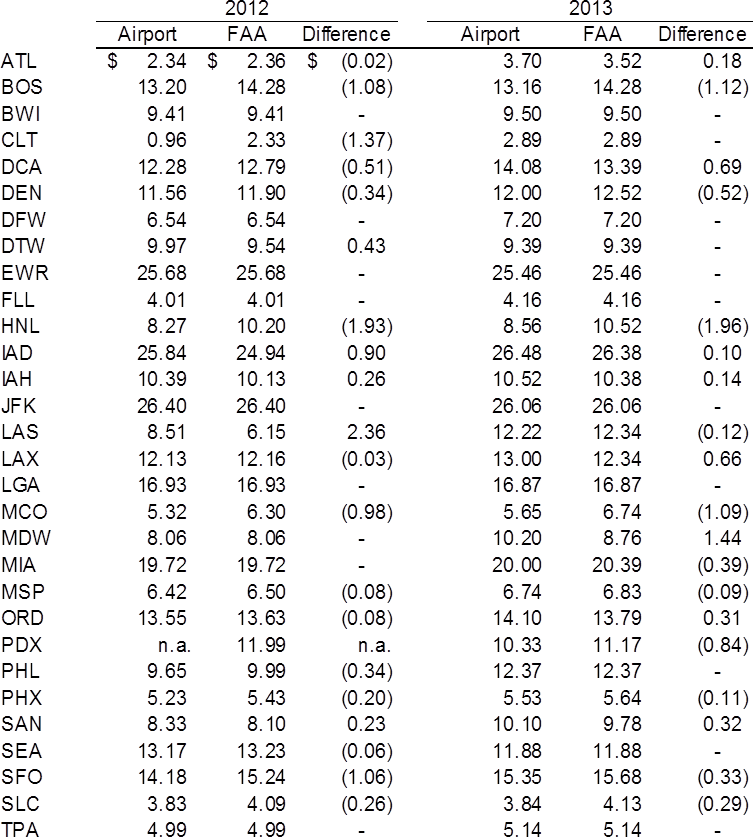

As discussed above, CPEs reported in FAA Form 5100-127 are calculated strictly based on accounting data, and enable us to identify specific adjustments made by each airport. The following table is a snapshot of FY 2012 and FY 2013 CPE comparison for all U.S. large hubs.

Note: CPEs listed under the Airport column were compiled from audited financial statements, official statements, rating agencies reports, and other documents, and may be extracted from FAA Form 5100-127 data if no other source is available, such as for airports managed by the Port Authority of New York and New Jersey.

After examining airport-reported CPEs vs. CPEs reported to the FAA, we can identify the following factors contributing to variances:

- Segments reported. For example, HNL reported a 2013 CPE of $8.56, which is the average passenger airline payment per enplaned passenger at Hawaii Airports System, rather than the CPE at HNL specifically. This contributed to a difference of nearly $2. Less obviously, some airports such as DCA and IAD report CPEs for the signatory airlines, which are different from CPEs for all airlines.

- Airline Revenue Sharing. Some airports, such as CLT, DEN and MCO, share net remaining revenues with signatory airlines and make payments from the account balance after a fiscal year closes. This allows those airports to recognize higher revenues on the financial statements and lower CPEs on other documents. For example, when airlines pay a total of $100 million for 10 million enplaned passengers and receive $20 million in revenue sharing, the airport recognizes $100 million on audited financial statements and calculates CPE to be $8.

- Other miscellaneous reasons. Some airports, such as SFO, do not exclude all-cargo airline paid landing fees when reporting CPEs. The FAA form 5100-127 forces all airports to exclude the landing fee revenues paid by all-cargo airlines, and thus causes a different reported CPEs. There are also other factors contributing to the CPE difference due to inclusion or exclusion of certain revenue items. For example, LAS recognized $51 million of historical year's due from airlines in FY 2012, causing its self-reported CPE to be $2 higher than the CPE reported to the FAA.

Understanding CPE Calculation

Three issues need to be examined before we can discuss an airport's CPE:

- How are airline revenues recognized?

- What items are included in CPE calculation?

- What additional items could be included in CPE calculation?

Recognizing Airline Revenues

As discussed in the airport finance videos of this website, three sets of rules govern the financial operations of each U.S. airport: GAAP, bond documents, and airline agreements. Specific to this article, airline agreements have a significant impact on how airline revenues are recognized and how CPEs are calculated.

First, selection of ratemaking approach can significantly impact CPEs. The following table illustrates the financial operation of the same airport under two different ratemaking methodologies:

|

Residual |

Comp. |

|

|

Revenues |

||

|

Airline Revenues |

$ 90 |

$ 120 |

|

Nonairline Revenues |

90 |

90 |

|

Total Revenues |

$ 180 |

$ 210 |

|

Operating Expenses |

(100) |

(100) |

|

Net Revenues |

$ 80 |

$ 110 |

|

Debt Service |

80 |

80 |

|

Debt Service Coverage |

1.00 |

1.38 |

|

Airline Revenues |

$ 90 |

$ 120 |

|

Enplaned Passengers |

10 |

10 |

|

CPE |

$ 9.00 |

$ 12.00 |

Due to airport rates and charges regulation, maximizing profits may not be a top priority for U.S. airports. Many airports may choose residual ratemaking, although they could generate more revenues under alternative ratemaking methodologies. When an airport indeed converts from a residual methodology to a compensatory methodology, such as MCO, SEA or SMF, the airport will generate higher airline revenues, which results in higher CPEs. An increase in CPE due to changes in the ratemaking approach is not an indicator of deteriorating financial performance.

Second, selection of year-end reconciliation methods can swing CPEs one way or the other. The following table presents an example of budget to actual variance.

|

Residual |

|||||

| Actual |

Options |

||||

|

Budget |

Collection |

Settle |

Transfer |

||

|

Revenues |

|||||

|

Airline Revenues |

$ 90 |

$ 120 |

$ 80 |

$ 120 |

|

|

Nonairline Revenues |

90 |

110 |

110 |

110 |

|

|

Total Revenues |

$ 180 |

$ 230 |

$ 190 |

$ 230 |

|

|

Expenses |

(100) |

(110) |

(110) |

(110) |

|

|

Net Revenues |

$ 80 |

$ 120 |

$ 80 |

$ 120 |

|

|

Debt Service |

80 |

80 |

80 |

80 |

|

|

Debt Service Coverage |

1.00 |

1.00 |

1.50 |

||

|

Airline Revenues |

$ 90 |

$ 80 |

$ 120 |

||

|

Enplaned Passengers |

10 |

12 |

12 |

12 |

|

|

CPE |

$ 9.00 |

$ 6.67 |

$ 10.00 |

||

For airports with residual ratemaking methodologies, all variances between budget and actual collection must be returned to airlines. In the example above, this airport realized higher passenger levels, higher expenses and higher airline and nonairline revenues than budgeted, resulting in a surplus of $40 million at the end of the year. The airport has two options:

- Conducting a year-end settlement, and returning surplus to airlines in the same fiscal year. In this case, CPE would be $6.67, or

- Transferring surplus to reduce the next year's airline rates and charges. The airport could record either $120 million or $80 million of airline revenues, depending on how Revenues are defined in bond document, and may present a CPE of $10.00.

- Airports may recognize this transfer of $40 million differently in the ensuing fiscal year, leading to more variations of CPE reporting

For airports with compensatory ratemaking methodologies, variances between the budget and the actual collection are separated into two components:

- Airlines' share, or over-collection, which is the difference between (a) the actual collection and (b) what the airport should have charged if the airport had perfect information to set the budget

- Airport's share, which is the remaining variance. In this example, the airport incurred more expenses, a portion of which need to be repaid by the airlines.

To make this calculation more complicated, some airports adopt a two-year process when crediting surplus to airlines:

- In year 0, the airport realizes that there could be an over-collection. Before year 0 ends, the airport needs to set rates and charges for year 1. Therefore, the airport estimates the overcollection could be $10 million, and gives the airlines a credit of $10 million for year 1.

- In year 1, when the airport finishes reconciliation for year 0, the airport realizes the overcollection is $12 million. Since a credit of $10 million has been provided to the airlines in year 1, the airport gives an additional credit of $2 million for year 2.

Determining CPE Revenue Items

Although there are no rules and regulations governing what revenue items should be included in the CPE calculation, U.S. airports typically exclude all payments from general aviation users and all-cargo airlines, and any payments from passenger airlines but not directly related to passenger operations. The CPE calculation typically does not take into consideration payments made to any third party other than the airport. The following table summarizes items included in CPE calculation:

|

Airfield |

Apron |

Terminal |

|

|

Included in CPE |

|

|

|

|

Excluded from CPE |

|

|

Identifying Additional Costs

An airline's operating expenses at a given airport include more than expenses paid to the airport. For example, the airline must hire employees or contractors to process passengers in the terminal, maintain or clean aircraft, or make fuel arrangements. Those expenses are typically not included in the CPE calculations of any airport.

However, the airlines may sometimes decide to take over certain services/responsibilities typically provided by airports. Those services may include, but are not limited to, the following:

- Financing terminal improvements

- Maintaining terminal facilities

- Financing or maintaining terminal equipment, such as outbound baggage systems or loading bridges

- Providing other customer services, such as porter services

The airlines have invested billions in financing terminal improvements across the U.S., including recent expansions of JFK Terminal 4 and Southwest's development at DAL. Historically, the airlines have financed Terminals A & B at BOS, Terminal 1 at ORD, Concourse B at CVG, and many unit terminals at LAX and PANYNJ airports. Many of those special facility bonds have been restructured during bankruptcy processes in the last decade.

In addition, the airlines at certain airports have formed consortiums to maintain terminal facilities, such as common-use terminal facilities at ATL or Terminal 4 at JFK. To a lesser extent, the airlines may maintain certain terminal equipment, such as airlines operating from the International Terminal of SFO, or American Airline at MIA. Those expenses are sometimes disclosed as additional costs. For example, ATL mentioned in the 2012A-C Official Statement that it received $22 million in airline payments through TBI Airport Management for common-use terminal facilities.

Using CPE

CPE has been widely used for many purposes in airport finance, each with a unique set of issues and concerns.

To Evaluate an Airport's Performance over Time

Airport managements are typically evaluated by their ability to maintain or develop air service, although they do not have direct control of air service. Therefore, airport managements pay close attention to airline payments, as a low level of payments could seemingly incentivize airlines to initiate or add service, and report CPE over time as an indicator of airport performance.

However, there are multiple issues involved in using CPE to evaluate airport performance:

- First, CPE is the unit cost of airline operations, which is determined by both the numerator, total airline payments, and denominator, total enplaned passengers. The numerator is relatively stable because airports need to maintain the same number of runways and terminal square footage regardless of passenger levels. Airports are not able to reduce operation expenses in proportion to changes in traffic levels. However, the denominator may change significantly due to economic events. During a sharp traffic downtown, such as the one that U.S. airports experienced in 2009, CPE spiked for many airports despite of airport managements' efforts to reduce expenses.

- Second, as discussed above, CPE can swing significantly due to changes in airline ratemaking methodologies, or changes in accounting recognition of revenues. Airports should not be punished by switching to a more profitable ratemaking methodology.

- Third, CPE is determined by the facility development cycle of an airport. Although terminal facility has a lifespan of 30 years or more, U.S. airports typically undertake a major capital program every 10 or 20 years, to ensure that they have an adequate aviation facility for local traffic needs. Every major capital project can be considered "over-built" when completed, since it is designed to accommodate traffic growth in the next 10 years. Therefore, when the facility opens, CPE increases to a high level, and declines gradually if no other major capital projects are undertaken, such as what MIA has been experiencing since 2012.

To Compare an Airport's CPE to Peers

Although it is a common knowledge that each airport is different and each airport's CPE is even more difficult to compare, many studies have been done to compare an airport's CPE to that of its peer, in order to argue that an airport's CPE is low (and, thus, attractive to airlines) or to argue that an airport's CPE is high (indicating that expense control is needed).

In summary, the following issues contributed to difficulties comparing airport CPEs:

- Physical facilities: a different set of facilities (number of runways, square footage of terminal facilities)

- Geographic locations: difference in standards of living and weather conditions (snow removal vs. air conditioning, as an example)

- Desired customer level: business-traveller-oriented airports vs. leisure markets

- Facilities and service provided: airport-financed/operated terminal vs. airline-financed/operated terminal

- Facility development cycle: completion of a major capital program vs. initiating a new capital program

- Ratemaking: difference in ratemaking methodology

- Revenue recognition: difference in recognizing airline revenues

- Economy of scale: operating expenses may not change with a 20% swing in traffic levels

To Guesstimate Airline Decisions

CPEs are sometimes used to (a) argue with airlines that they could afford a capital project at a given airport, or (b) imply that an airport is attractive to airlines due to low CPE level. In either case, we are guesstimating airlines' decision-making process, when we have much less information than the airlines do.

First, CPE accounted for only a small portion of airlines' operating expenses at an airport. According to a presentation by Airlines for America in February 2015, landing fees and terminal rentals accounted for 5% of airlines' operating expenses in 2014. Fuel expenses, salaries and wages, and other expenses accounted for majority of operating expenses. Therefore, an increase of 20% in CPE would only translate into 1% increase in total expenses, and may not swing an airline's operating decision.

Second, airlines often make route decisions although such decisions may lead to significant increase in CPEs. An extreme example is Delta's dehubbing at CVG. In 2005, CVG had 11.3 million of enplaned passengers, with more than 90% on Delta flights. Under a residual ratemaking methodology, Delta would pay a majority of airline revenues regardless of the actual level of enplanements. Any service reduction would simply lead to a higher CPE, without reducing Delta's total payments to the airport. Nevertheless, Delta dehubbed at CVG, reducing CVG's total enplaned passengers to 2.9 million in 2013. Despite of airport management's aggressive actions to cut airport expenses, the CPE increased from below $5 in 2005 to $10 in 2013.

Third, fare revenues are typically more meaningful to airlines than are CPEs. This is evidenced by regional airport competition such as SFO vs. OAK and SJC, or BOS vs. MHT and PVD. In both cases, airlines flocked to the large-hub airports with more business travelers and higher fares, and withdrew from smaller markets.

Fourth, airlines will continue to provide different answers regarding whether CPE matters. While legacy network carriers have indicated that CPE, or an airline incentive program, is not a top consideration in their route planning process, ultra lower cost carriers (ULCCs) are much more interested in operating in a low-airport-cost environment. This is because each airline derives different level of revenue from the same airport. According to the Department of Transportation's DB1B database, legacy network carriers such as Delta and United received on average $260 to 270 per one-way trip ticket in the third quarter of 2014, while ULCCs such as Allegiant and Spirit received on average $100. A summary of historical domestic fare data can be found in this link, which does not include ancillary fees.

Finally, airlines' route decisions are based on a large mix of factors including operations, staffing, networks, competition, and other factors, as well as fare revenues and CPEs. Therefore, lower CPE does provide adequate incentives for airlines to initiate or add services, and is only one relatively minor factor in this decision-making process.

Supplementing CPE

Airport finance professionals have made numerous efforts to address concerns when using CPE for different purposes, mostly centered on making CPEs more comparable. Therefore, each airport's CPE is adjusted to reflect tenant financed or operated facilities and equipment, as well as payments made to third party contractors for services typically offered by other airports. In some of the studies, planned capital program costs have been added to the calculation of future CPE, so the CPEs of airports in different stages of implementing large capital programs can be comparable. Other factors contributing to CPE comparison problems continue to be ignored, such as differences in costs of living, ratemaking methodologies, and revenue recognition.

Other efforts have been made to study all-in costs of an airline at a given airport, by incorporating aircraft taxiing time and delay costs. This is a step closer to simulating airline route planning, but falls short by ignoring fare revenues, stage length, fuel costs, employee salaries and wages, network, and competition, among many other considerations.

Nevertheless, CPE will continue to be the most important metric in the airport finance world, due to its reliability and accuracy (as it is calculated using accounting data), availability (provided by almost all airports) and simplicity (one number tells a lot about an airport). It is also far superior to other alternatives such as debt service coverage, which is meaningless for airports with residual ratemaking methodologies. Other financial metrics can be calculated to supplement CPE information, such as:

- Percentage change of airline payments, which excludes the impact of changes in enplaned passengers to a certain degree

- Airline payments as a percentage of total revenues, which indicates degree of diversity of revenues

- CPE as a percentage of average fare revenues, although calculation of fare revenues is heavily debated

- Breakeven CPE, which shows the CPE needed to achieve breakeven result

The following table shows a hypothetical calculation of breakeven CPE for LAX, using the 2015ABC Official Statement. When we project that LAX could break even at a CPE level of $13.58 in 2020, should we be concerned that LAX may charge up to $22.82?

|

FY 2020 |

||

|

PROJECTIONS IN 2013AB OS |

||

|

CPEs |

[A] |

$ 22.82 |

|

Net Funds Remaining (000s) |

[B] |

$ 367,044 |

|

Enplaned Passengers (000s) |

[C] |

39,707 |

|

Potential Reduction in CPEs |

[D]=[B]/[C] |

$ 9.24 |

|

Breakeven CPEs |

[A]-[D] |

$ 13.58 |

Note: This is a simplified calculation and does not take into account secondary impacts such as of cargo airline landing fees.