Airport Debt Service Calculation

(November 26, 2017 by Dafang Wu; PDF Version)

If an airport has issued general airport revenue bonds to fund capital projects, the top priority of its financial operations is to meet the requirements of the bond document, such as generating enough revenue to pay debt service. The calculation of debt service is fairly complicated, as detailed below.

Debt Service Basics

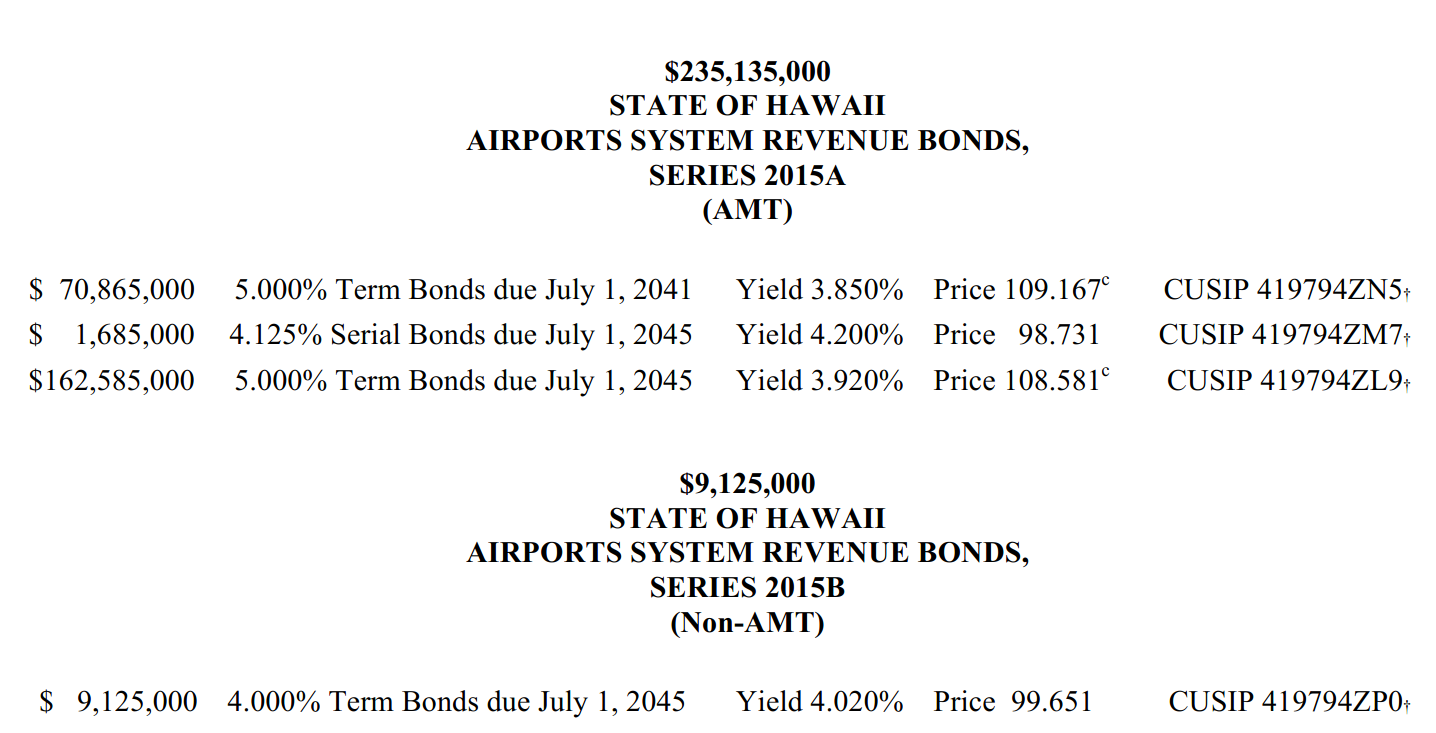

An airport may include multiple series in one bond issue. The State of Hawaii issued $244.3 million of Airport System Revenue Bonds in 2015. This $244.3 million is referred to as the par amount or the principal amount. A major component is subject to Alternative Minimum Tax (AMT).

The $244.3 million will not be repaid on one day. Instead, the State specified a series of principal maturity dates, which all fall on July 1, the first day of the State fiscal year.

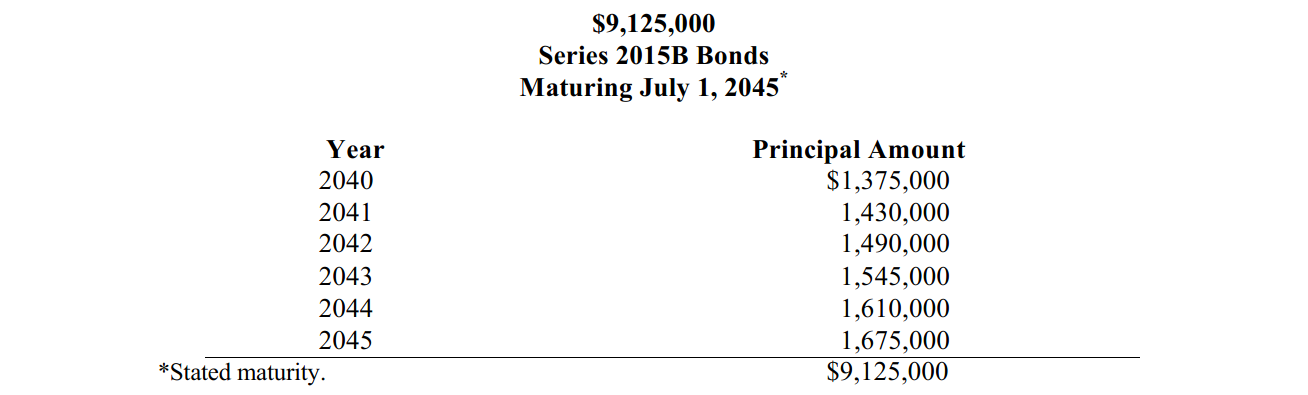

A serial bond typically includes many annual installments, although the example above includes only one serial bond payment. A term bond includes multiple bonds with the same maturity date, but typically has a mandated redemption schedule. The 2015B term bonds included six sinking fund redemptions. In this case, the principal repayment on July 1, 2040 is effectively $1.375 million.

In addition to the annual principal repayment, the State must pay interest semiannually on January 1st and July 1. The 2015B bonds have a stated interest rate (the coupon rate) of 4.000%, which means the State will pay $9.1 million X 4.000% over two equal interest payments annually. The 2015B bonds were sold to investors at $99.651 per $100, i.e., at a discount, so the effective interest rate (the yield) is higher, at 4.020%.

Deposit Basis vs. Cash Basis (Payment Basis)

The amount of debt service in a fiscal year can be calculated on a deposit basis or a cash basis:

- Deposit basis measures the amount to be deposited from the Airport Revenue Fund to a debt service fund during a fiscal year. As shown in the table below, the State would deposit $145,000 monthly in FY 2040 ending June 30, 2040, totaling $1.74 million.

- Cash basis measures the amount to be paid out of the debt service fund during a fiscal year. In FY 2040, the cash basis debt service includes the payments on July 1, 2039 and January 1, 2039, which total only $365,000.

|

(in thousands) |

||||||

|

Action |

Date |

Principal |

Interest |

Total |

Deposit Basis |

Cash Basis |

|

Payment |

7/1/2039 |

$ 183 |

$ 183 |

$ 183 |

||

|

Deposit |

7/5/2039 |

115 |

30 |

145 |

145 |

|

|

Deposit |

8/5/2039 |

115 |

30 |

145 |

145 |

|

|

Deposit |

9/5/2039 |

115 |

30 |

145 |

145 |

|

|

Deposit |

10/5/2039 |

115 |

30 |

145 |

145 |

|

|

Deposit |

11/5/2039 |

115 |

30 |

145 |

145 |

|

|

Deposit |

12/5/2039 |

115 |

30 |

145 |

145 |

|

|

Payment |

1/1/2040 |

183 |

183 |

183 |

||

|

Deposit |

1/5/2040 |

115 |

30 |

145 |

145 |

|

|

Deposit |

2/5/2040 |

115 |

30 |

145 |

145 |

|

|

Deposit |

3/5/2040 |

115 |

30 |

145 |

145 |

|

|

Deposit |

4/5/2040 |

115 |

30 |

145 |

145 |

|

|

Deposit |

5/5/2040 |

115 |

30 |

145 |

145 |

|

|

Deposit |

6/5/2040 |

115 |

30 |

145 |

145 |

|

|

Payment |

7/1/2040 |

1,375 |

183 |

1,558 |

||

|

Total |

$ 1,740 |

$ 365 |

||||

|

|

|

|

|

|

|

|

A definition on a deposit basis may read, “Debt Service means … debt service accrued and to accrue …” or “… deposited or to be deposited in Debt Service Fund.” A definition on a cash basis may read, “Debt Service means … the amount become due and payable …” Some airports adopted an alternative way to achieve debt service on a deposit basis – “principal payable … commencing with July 2 in such fiscal year and ending with July 1 of the next fiscal year, both inclusive.” This ensures that the July 1 payment in the ensuing fiscal year is counted as the debt service in the current fiscal year.

Regardless of how the debt service definition is written, an airport is required to make monthly deposits into the debt service fund and other funds, referred to as application of revenues or flow of funds. Because the airport must generate enough revenue in the fiscal year to meet those deposit requirements, debt service on a deposit basis is a better measure of an airport’s obligations. In the example above, if an airport uses debt service on a cash basis and collects $365,000 from the airlines, it must find other revenue to meet the deposit requirements of $1.74 million.

As of today, some U.S. airports are still using cash basis accounting, which is probably the reason why cash basis debt service is used in the first place. Over time, some airports, such as HNL and SFO, have amended their indentures to define debt service on a deposit basis, while other airports, such as ATL, continue using cash basis for both financial operations and debt service calculation.

Fiscal Year vs. Bond Year

The fiscal year for many U.S. airports ends on the last day of a quarter, such as September 30. Some airports have fiscal years ending in February, April, August or October. Many airports set the first day of a fiscal year as the bond principal payment date, which makes their bond year the same as their fiscal year. Alternatively, the principal date can be set on any date. At least one U.S. airport sets a different bond maturity date for each issue, which seems to be a huge administrative burden.

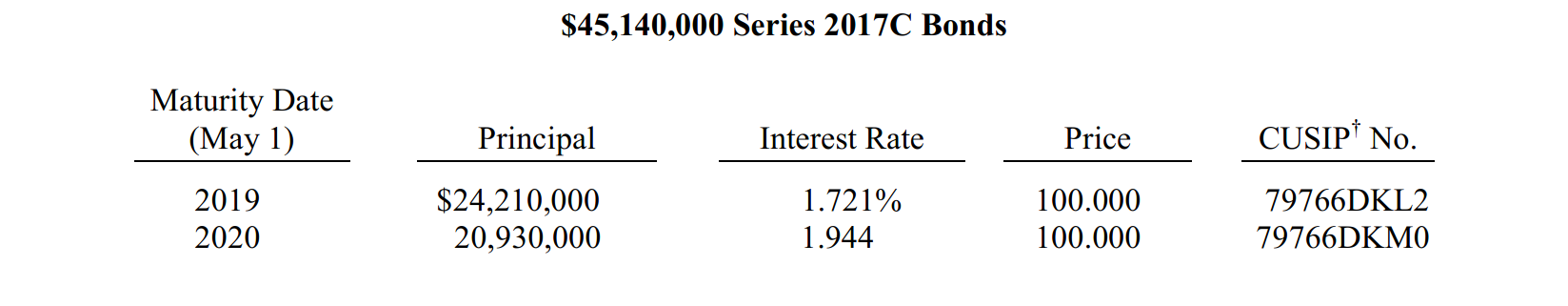

The calculation of debt service gets more complicated when the principal repayment date falls in the middle of a fiscal year. For example, San Francisco Airport Commission’s fiscal year ends June 30, and the principal repayment date is May 1.

For the first 10 months of FY 2019 ending April 30, 2019, the Airport will make monthly deposits to meet the principal payment of $24.21 million on May 1, 2019. For the last two months, the monthly deposit is made for the May 1, 2020 payment of $20.93 million. The interest deposit follows the same pattern, leading to the variance between the deposit basis and the cash basis.

|

(in thousands) |

||||||

|

Action |

Date |

Principal |

Interest |

Total |

Deposit Basis |

Cash Basis |

|

Deposit |

7/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

8/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

9/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

10/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Payment |

11/1/2019 |

412 |

412 |

412 |

||

|

Deposit |

11/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

12/5/2019 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

1/5/2020 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

2/5/2020 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

3/5/2020 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Deposit |

4/5/2020 |

2,018 |

69 |

2,086 |

2,086 |

|

|

Payment |

5/1/2020 |

24,210 |

412 |

24,622 |

24,622 |

|

|

Deposit |

5/5/2020 |

1,744 |

34 |

1,778 |

1,778 |

|

|

Deposit |

6/5/2020 |

1,744 |

34 |

1,778 |

1,778 |

|

|

Total |

$ 24,417 |

$ 25,034 |

||||

|

|

|

|

|

|

|

|

|

Note: Interest includes $24.21M at 1.721% and $20.93M at 1.944%. |

||||||

Exclusions and Adjustments

The debt service schedule in the body of an official statement presents the amount the bondholders would receive annually, not the debt service to be deposited/paid by the airport annually. The difference includes many exclusions and adjustments:

- Capitalized interest, which is the amount of interest payment to be paid from bond proceeds. Because airlines will not receive the benefits of a new facility before completion and thus are unwilling to pay related interest, many airports borrow interest payments as part of bond proceeds. Those amounts are already within the debt service fund and are always excluded from the debt service defined in the bond document.

- Interest earnings of the debt service fund. For some airports, the interest earnings of the debt service fund are specified to stay within the fund. Therefore, the airport would need to deposit only the difference between the annual debt service and realized earnings.

- Available Passenger Facility Charge (PFC) Revenues/LOI Revenues. The new indentures adopted over the last decade began using a definition of Available PFC/LOI/Other Revenues, and excluding those amounts from the calculation of debt service. Because those amounts are available from sources other than the Revenue Fund, an airport will need to make only the net deposit.

- Other funds. Some airports have a more flexible definition of debt service, and exclude debt service “…payable from funds set aside or deposited for such purpose.” Other than PFC/LOI revenue, an airport may decide to deposit the prior year settlement amount or even a discretionary contribution to the debt service fund, and reduce the debt service defined in the indenture.

Rate Covenant and Additional Bond Test

An airport consultant’s role in a bond issuance may include:

- Providing a bond feasibility study, which is a marketing document evaluating an issuer’s ability to meet the rate covenant in the bond document.

- Providing an additional bond test certificate, if needed; this is a legally required document in the bond document when issuing new money or even refunding bonds.

- Assisting the issuer in reviewing documents and participating in related activities.

The debt service used in a bond feasibility study is typically different from the debt service in the additional bond test:

- The bond feasibility study may include all future bonds the issuer may issue to support a capital program, while the additional bond test certificate reflects only the current issue and any necessary completion bonds.

- The bond feasibility study reflects management intentions instead of legally committed actions. For example, if the debt service excludes any amount deposited into the debt service fund, a bond feasibility study may exclude deposits planned for future years. The additional bond test, on the other hand, excludes only amounts already deposited as of the date of issuance

- The debt service definition may include a special section for the additional bond test. For example, debt service on variable rate bonds is typically estimated by the financial advisor for the purpose of a bond feasibility study. For the additional bond test, the variable rate bond may be required to carry a much higher estimated interest rate.

In summary, each airport has its own bond document and different definitions of debt service. A modern-day definition may include multiple pages, including detailed calculations of the balloon payment, variable rate bonds, auction rate bonds and the hedging agreement, among other contents. A bond counsel interprets the bond document and a financial advisor provides the debt service schedule, which are the parties an airport consultant can consult when evaluating debt service.