Airline Capital Review and Majority-in-Interest

(November 27, 2017 by Dafang Wu; PDF Version)

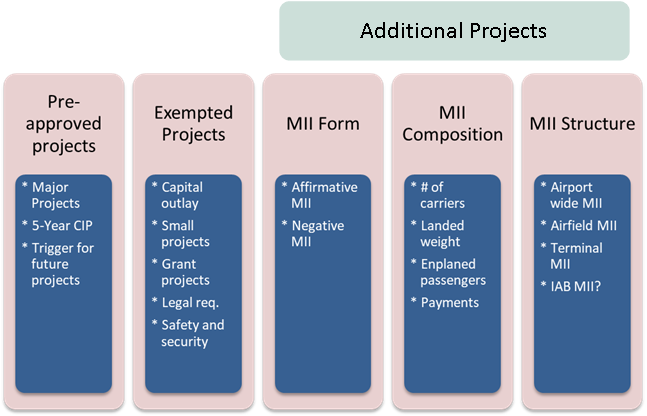

An airline use agreement covers many aspects of the business arrangements between an airport and airlines, with three primary issues: rates and charges, capital review, and facility control. Embarking on a multi-billion-dollar capital program can provide exciting opportunities for airlines to expand service and for the airport to grow, but may also disrupt a relationship that will take years to recover. A carefully designed capital review process can clarify each party’s rights and obligations, as well as avoid conflicts during the term of the agreement. The capital review process is closely tied to the airport rates and charges methodology and is illustrated as follows:

Fundamental Issues

While an airport wants the unfettered ability to undertake capital projects, airlines’ willingness to fund a large capital program is restricted by three issues: cost of capital, the facility development cycle, and competition.

- The airline industry has a higher cost of equity and a higher cost of debt compared to the airport industry. According to the excellent quarterly industry review and outlook presentation prepared by Airlines for America, U.S. airlines were able to generate a hefty profit of $62 billion from 2010 to 2016. However, from a longer perspective, investing in the airline industry is as risky as investing in cryptocurrencies, which must be compensated by high returns. Similarly, the bond ratings of U.S. airlines scatter from BB to BBB, compared to ratings of A to AA for U.S. airports. Therefore, the airlines want the airport to carry debt at the airport’s expense for as long as possible, so the airlines will not have to pay earlier than necessary.

- Interest payments on general airport revenue bonds are typically capitalized through the date of beneficial occupancy

- The airlines are unwilling to pre-fund a rate stabilization fund, which will smooth the rate increase when implementing a large capital project

- The airlines are unwilling to provide a security deposit, which could be as high as three months of rates and charges

- The airlines prefer that any year-end over-collection/settlement be returned as cash or credit, instead of rolling forward to reduce rates.

- The airlines want the airport facility to be delivered just-in-time to meet the capacity needs. However, airport facility development is cyclical. When an airport implements a major capital program such as a terminal, it would consider not just the existing demand but also the anticipated demand over the next five to 10 years, if not longer. This means that every terminal, when completed, would be inherently larger than the current needs. When an airport has airport-wide residual ratemaking, the airline payments are increased to pay for vacant space. Even at airports with commercial compensatory terminal ratemaking, a portion of the new terminal cost may be blended with the existing terminal cost, increasing the terminal rental rate across the board. This cost increase is especially difficult for an airline to accept if the specific airline will continue occupying an old facility instead of the new one.

- Airline competition is a major consideration in determining capital projects. In the example of unified terminal ratemaking above, an airline not occupying the facility would also need to pay higher costs. Although there are some benefits, such as an additional capacity to expand, an airline may object to the project. In a hub airport, the hubbing airline may also be concerned that the construction of an additional facility would invite new entrants, although on some occasions that is precisely the airport’s intention.

Capital Review

The capital review process is closely tied to the airport rates and charges methodology. As discussed in separate articles, an airport may adopt a residual ratemaking methodology and ask the airlines to pay whatever is necessary to keep the airport running. The airlines would theoretically take unlimited risks. To mitigate such risks, the airlines require strong control of capital planning because they will be the party responsible for the related costs.

On the other hand, some airports implement rate by ordinance or have airline agreements with compensatory ratemaking methodologies. The airport is responsible for generating enough revenue to meet all obligations. Because the airlines will pay for only their fair share of airport costs, they typically have limited or no control over what capital projects will be built.

The capital review section in the airline use agreement answers the following questions:

- What projects are pre-approved?

- What projects are exempted?

- What is the process to review additional projects?

Pre-approved Projects

Pre-approved projects may include one major capital program such as a new terminal or a five-year capital improvement program (CIP) including hundreds of projects. Therefore, the pre-approved project section will include:

- The scope of the program or CIP. The list of pre-approved projects is typically included as an exhibit, without detailed description of the scope. That is because the airline agreement may be entered at a very early stage of a program, when the detailed scope has not been finalized. Airports should design the capital review process to allow for minor changes in scope. Otherwise, an additional airline review process may be triggered, stalling the construction process.

- Estimated total costs and funding sources. In many cases, the total costs are spelled out in the airline agreement, leaving the airport to refine the plan of finance afterward. When the plan of finance relies on a large chuck of uncertain funding sources, such as FAA grants, TSA grants or passenger facility charges, the airport may commit to using those funding sources, although the amount remains uncertain.

- Cost increase and additional review. The estimated total costs already reflect construction cost escalation, soft costs and contingencies. Nevertheless, some capital programs may go over budget due to unexpected situations. If the increase is lower than a specified threshold, such as 10%, the airport can proceed without consulting the airlines. Otherwise, the airport may be required to undertake a value engineering exercise or reduce the scope of ancillary projects. Because the airport has a limited ability to stop the construction of a major capital program, the airport should avoid committing to seeking airline approval for a cost increase. For a capital program with multiple projects, the airport should seek to set the threshold at the program level instead of the project level. The airport can then offset the cost increase of a component with savings from other projects, thereby avoiding a lengthy capital review process

- Triggering event. For an airline agreement with a relatively long term, an airport may add a triggering event, such as starting an additional phase of terminal projects if the enplaned passenger exceeds a certain level. This additional phase is exempted from airline review, and ensures the airport can accommodate additional traffic demand.

Exempted Projects

During the normal course of operations, an airport must undertake capital projects to keep the airport running. Those projects may include small capital outlay, equipment purchases, vehicle projects and major capital projects. Under a residual ratemaking methodology, an airport has little or no discretionary cash. Therefore, the airport must ensure that the absolutely necessary projects are exempted from airline review. Under a residual ratemaking methodology, such exemptions may include:

- Small capital outlay up to a certain dollar amount annually.

- Capital projects that have low construction costs such as $1 million and low operating expenses. To avoid an airport breaking down large projects into smaller components, there is typically an annual aggregate limit, in addition to the per-project limit.

- Capital projects with a majority of costs funded by an FAA grant or other grants.

- Capital projects to meet the requirements of federal, state or local agencies.

- Capital projects to settle claims as mandated by the court.

- Capital projects related to safety and security.

Other exemptions may include:

- Capital projects that are not anticipated to increase airline rates and charges. The airlines are not in favor of this item because an airport may use this exemption to fund a non-airline project such as a parking garage or hotel. Even if such projects are anticipated to break even or generate a small profit, the airlines are unwilling to take on the additional risks.

- Special facility or airline-funded facility. When an airline agrees to fund a separate facility without increasing rates for other airlines, other airlines may not have the right to veto the facility. However, due to airline competition concerns, this clause is seldom seen in an airline agreement.

- Capacity project to accommodate an airline request. Similarly, this is a clause the airport often raises to ensure capacity, though the airlines often deny it.

If the airlines do not offer residual protection to an airport, the capital review section may not exist in the airline agreement. Even if a section is included, many other items are exempted from airline review, such as projects in non-airline cost centers.

Review of Additional Projects

When an airport has additional projects that are subject to airline review, the airline use agreement may include either an affirmative majority-in-interest (MII) or a negative MII:

- Affirmative MII means that, to proceed, an airport must receive approval from the majority. If half the airlines decide not to respond, the project is considered disapproved.

- Negative MII means that an airport can proceed unless it receives disapproval from the majority. If half the airlines decide not to respond, the project will proceed.

In either case, an airport would submit the project to MII for airline review and specify a response date. If the airlines disapprove a project, the airport may have the right to resubmit for consideration. The industry is quite divided on what should happen if the airlines disapprove a project for the second time:

- Some airports believe they should have the right to proceed with the project after deferring the project for a nominal period, typically no longer than a year. Most large-hub airports have enough marketing power to obtain this clause.

- Some airports believe they should not proceed if the airlines do not want the project. If the airlines reject the project twice, the project is put on the shelf indefinitely.

There are two additional issues surrounding the MII: composition (based on landed weight, number or enplaned passengers), and structure (airport-wide MII vs. separate MIIs for airfield and terminal). Each airport has a fascinating story about how its MII is determined.

- Hub airports. When a single airline accounts for more than half the traffic at an airport, the first decision is whether this hub carrier should have the right to singlehandedly approve or disapprove any capital projects at the airport. On the airport side, there are two schools of thought:

- One side believes that the opinion of the hub carrier should dominate because the carrier is in charge of paying a large share of airport revenues and therefore bears the corresponding share of the risks. The MII will then be designed so that it is based on the percentage of enplaned passengers at 50% or more. Sometimes the airport would set the threshold above the hub carrier’s ratio to ensure the hub carrier must obtain support from at least one other major carrier.

- The other side believes the interests of the smaller carriers should matter. Suppose the hub carrier’s market share is 60% (either landed weight or enplaned passengers); the MII ratio may be set at 25%. This ensures that the smaller carriers could veto a project proposed by the hub carriers if the project negatively affects the interests of all other carriers. It also ensures that the smaller carriers could proceed with a project even if the hub carrier opposes it.

- O&D airports. For O&D airports with a diverse mix of carriers, the MII composition is much simpler and is typically set between 50% and 60% of airport traffic. Using the number of signatory carriers for affirmative MII criteria could be tricky. If a large airport has more than 30 or 40 signatory airlines, obtaining a written response from half the airlines may be difficult.

In recent years, more airports began embracing cost center MII rather than airport-wide MII. Under the cost center MII structure, the MII for an airfield project is based on landed weight, and the MII for a terminal project is based on terminal space, enplaned passenger or payment. This trend seems reasonable because it better matches the risk with control. There has been no additional MII development such as a separate MII for domestic vs. international facilities, but one is likely to emerge as airports continue finding ways to fund their desired projects.

Conclusion

Under residual ratemaking, the airlines agree to collectively pay whatever is necessary to keep an airport running, and theoretically bear unlimited risks. The purpose of the capital review section is to limit the construction costs, and therefore limit the risks to the airlines. The airports, on the other hand, still want to proceed with their projects, and most large-hub airports are able to negotiate in their favor.

Under a compensatory ratemaking in which the airlines do not offer residual protection, the capital review section should not be needed. Some airports still agree to certain forms of airline capital review as a good-faith gesture, but those procedures should be consultations rather than reviews and approvals.