Cryptocurrency Speculation and Blockchain Stocks

(December 16, 2017 by Dafang Wu; PDF Version)

After Chicago Board Options Exchange began transactions of Bitcoin future contracts last week, cryptocurrency (“coin”) is becoming mainstream. We are quite late to this game, as many coins have appreciated more than 100 times so far this year, but it is never too late. This situation is similar to the early era of internet development, so we will need to understand the situation and cautiously catch up.

Similar to many articles I wrote on airport finance, this article provides information rather than recommendations. Many coins are almost scams; many publicly traded companies claiming to be in blockchain technology, especially those traded over-the-counter (OTC), are also scams. Therefore, further research is required to make investment decisions, if we call coin speculation an “investment.”

Background

Instead of discussing the history of coins or technology, here are the basics that we need to know:

- Coins are digital currencies issued by organizations or teams; ownership and transactions are recorded in a public ledger

- There are more than 1,000 coins, with Bitcoin having the highest market capitalization of nearly $300 billion

- Each coin has a name, such as Bitcoin, and a trading ticker like stock, such as BTC

- There are more than 7,000 coin exchanges

- Some exchanges allow us to purchase coins using real life money, which they refer to as fiat money

- Some exchanges are not regulated, and only allow us to trade among coins. For this type of exchange, Bitcoin is typically the currency. To switch between two other coins, we will need to sell the first one and receive Bitcoin, and use the Bitcoin to purchase the second one

- There is no customer service for any coin – if we accidentally lose it or send to a wrong party, there is no way to get back

- Security threat and fraud always exist for coin trading – search Mt. Gox

If we still decide to put a small amount of portfolio into coins, there are three approaches:

- Buy coins

- Buy cryptocurrency stocks or Exchange-Traded Funds (ETFs)

- Initial Coin Offering (ICO), which I will not address in this article

Buying Coins

There are many websites providing articles on how to purchase Bitcoin with U.S. dollar. One relatively safe approach is to purchase from https://www.coinbase.com, because Coinbase is insured by Federal Deposit Insurance Corporation up to $250,000. After a relatively easy verification process, Coinbase will set a transaction limit for purchase on credit card (higher fees), bank account, and wire transfer, and transaction may initially take several days due to security reasons. If the initial limit is set at $3,000 per week, wire transfer of additional money will stay in the USD wallet until the limit is replenished over time.

Coinbase offers three coins: Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), because Coinbase positions itself as an exchange for beginners. I purchased ETH instead, because transaction time and cost for BTC are getting worse. After we purchase ETH, we can easily send ETH to anywhere in the world. As of today, there is no regulation prohibiting sending ETH overseas.

https://coinmarketcap.com/ is probably the website providing the most comprehensive information on coins and exchanges. The trading volume page ranks all exchanges by volume, with Bithumb in South Korea as the largest. Not all exchanges provide trading of all coins. If we have a particular coin in mind, we need to check the available exchanges on Coinmarketcap, such as this page for Monero. I registered at Bitfinex and mainly use Bittrex. Both appear to be top legit exchanges, with relatively easy verification process.

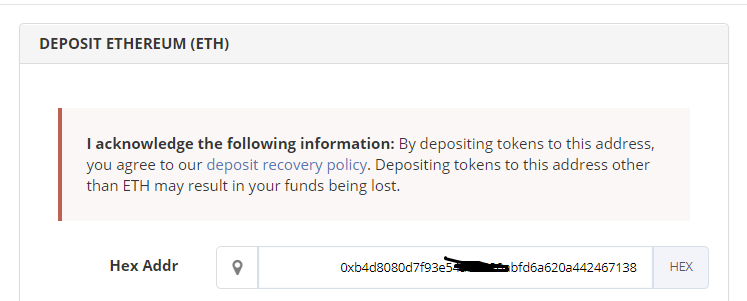

After an account is established, we can go to the wallet, and click “+” beside the ETH symbol. A very long address will show up, such as 0xb4d8080d7f93e54xxxxxxxxxx620a442467138.

This is the address we should put into the “send” address in Coinbase. It is very important that we copy and paste the correct address. Otherwise the fund is lost forever, and no one has ability to help. For any new account, always send a small payment to test. ETH transactions should complete within an hour or much faster, but BTC transactions may take longer.

This page lists the coins (and tokens, which we can view them as coins) by market cap. The following table is my personal note for the top 50 coins as of December 16, 2017, with interesting coins highlighted. To re-iterate, this article provides information but not recommendations.

| Rank | Name | Ticker | Market Cap (mil) | USD Price | Daily Volume (mil in USD) | Chart | Personal Observation |

| 1 | Bitcoin | BTC | $ 298,219 | $17,810.10 | $ 11,472 | Chart | It serves as a digital currency but has not other functions |

| 2 | Ethereum | ETH | 67,608 | $701.56 | 2,261 | Chart | Smart contract that most tokens rely upon, criticized for transaction congestion |

| 3 | Bitcoin Cash | BCH | 31,087 | $1,844.02 | 1,160 | Chart | Offspring of bitcoin |

| 4 | Ripple | XRP * | 30,144 | $0.78 | 2,186 | Chart | It serves as a digital currency, adopted by many banks including Bank of America |

| 5 | Litecoin | LTC | 16,369 | $301.31 | 2,145 | Chart | Similar to bitcoin but better processing speed and lower cost |

| 6 | IOTA | MIOTA * | 11,228 | $4.04 | 324 | Chart | Uses a new but less-tested technology called Tangle instead of blockchain |

| 7 | Dash | DASH | 7,190 | $927.09 | 169 | Chart | Similar to bitcoin, but with privatesend, a function to make transaction hard to trace |

| 8 | Cardano | ADA * | 5,678 | $0.22 | 149 | Chart | Re-engineered similar to Ethereum, claiming to be most advanced |

| 9 | NEM | XEM * | 5,633 | $0.63 | 53 | Chart | Claiming to be a better alternative than ethereum, with ability to scale |

| 10 | Monero | XMR | 5,125 | $331.02 | 155 | Chart | Similar to bitcoin, but designed to be non-traceable; form of ransom by some hacks |

| 11 | Bitcoin Gold | BTG | 5,117 | $306.23 | 163 | Chart | Offspring of bitcoin |

| 12 | EOS | EOS * | 4,859 | $8.96 | 637 | Chart | Designed to be an operating system to enable blockchain development; conceptual stage |

| 13 | Ethereum Classic | ETC | 3,617 | $36.76 | 954 | Chart | Offspring of bitcoin, resulting from a prior hack |

| 14 | Stellar | XLM * | 3,563 | $0.20 | 178 | Chart | New technology tested by IBM |

| 15 | NEO | NEO * | 3,239 | $49.84 | 172 | Chart | New technology mostly used in China |

| 16 | Qtum | QTUM * | 2,270 | $30.79 | 1,279 | Chart | A blend of bitcoin and ethereum |

| 17 | Populous | PPT * | 2,016 | $48.87 | 6 | Chart | Invoice financing on blockchain |

| 18 | BitConnect | BCC | 1,946 | $406.44 | 27 | Chart | A digital currency but with interest; criticized by some as a ponzi scheme |

| 19 | OmiseGO | OMG * | 1,421 | $13.93 | 224 | Chart | A digital currency focusing on remittance |

| 20 | Zcash | ZEC | 1,379 | $484.51 | 189 | Chart | Encrypted transaction similar to Dash |

| 21 | Waves | WAVES * | 1,362 | $13.62 | 84 | Chart | New platform with ability to issue token and decentralized exchange |

| 22 | TRON | TRX * | 1,318 | $0.02 | 126 | Chart | Smart contract designed for entertainment industry |

| 23 | Lisk | LSK * | 1,230 | $10.61 | 50 | Chart | Smart contract developed for JavaScript developers, with sidechain |

| 24 | BitShares | BTS * | 1,038 | $0.40 | 89 | Chart | Digital currency with decentralized exchange |

| 25 | Tether | USDT * | 1,033 | $1.01 | 1,763 | Chart | Digital currency aiming to be worth exactly $1 |

| 26 | Stratis | STRAT * | 1,023 | $10.37 | 32 | Chart | Blockchain as a service platform for other business to develop technology |

| 27 | Ardor | ARDR * | 938 | $0.94 | 15 | Chart | Blockchain as a service platform, built on NXT |

| 28 | Hshare | HSR | 922 | $21.75 | 74 | Chart | Digital currency, can't seem to see difference from other coins |

| 29 | MonaCoin | MONA | 808 | $14.42 | 9 | Chart | Digital currency with ATMs in Japan; otherwise no difference from LTC |

| 30 | Nxt | NXT * | 701 | $0.70 | 59 | Chart | Confusing development with ARDR; need to read more |

| 31 | Veritaseum | VERI * | 571 | $281.89 | 1 | Chart | Avoid; many claim this is a scam |

| 32 | Bytecoin | BCN | 525 | $0.00 | 3 | Chart | Digital currency claimed to be non-traceable |

| 33 | Steem | STEEM * | 523 | $2.12 | 5 | Chart | Social media rewarding content using altcoins |

| 34 | Komodo | KMD | 491 | $4.74 | 23 | Chart | Offspring of ZEC, claiming to be more secure and private |

| 35 | SALT | SALT * | 469 | $9.19 | 21 | Chart | Token to allow people borrowing true $ using altcoins as collateral |

| 36 | Decred | DCR | 468 | $73.49 | 3 | Chart | Digital currency, can't seem to see difference from other coins |

| 37 | Ark | ARK * | 445 | $4.55 | 8 | Chart | Bridges different blockchain and provide a platform for mass adoption |

| 38 | Dogecoin | DOGE | 442 | $0.00 | 18 | Chart | Digital currency for fun |

| 39 | Einsteinium | EMC2 | 435 | $2.01 | 62 | Chart | Digital currency contributing to its own non-profit organization |

| 40 | Augur | REP * | 416 | $37.83 | 5 | Chart | Open-source prediction market (which I absolutely disagree) |

| 41 | Binance Coin | BNB * | 415 | $4.19 | 55 | Chart | Digital currency used by Binance Exchange |

| 42 | Golem | GNT * | 357 | $0.43 | 8 | Chart | Decentralized supercomputer |

| 43 | Siacoin | SC | 353 | $0.01 | 9 | Chart | Cloud storage |

| 44 | Vertcoin | VTC | 350 | $8.32 | 16 | Chart | Digital currency, can't seem to see difference from other coins |

| 45 | Electroneum | ETN | 341 | $0.07 | 9 | Chart | Digital currency for mobile/online gaming |

| 46 | Verge | XVG | 331 | $0.02 | 45 | Chart | Digital currency claimed to be non-traceable |

| 47 | Status | SNT * | 329 | $0.09 | 38 | Chart | Social media |

| 48 | PIVX | PIVX * | 326 | $5.92 | 3 | Chart | Digital currency claimed to be non-traceable |

| 49 | RaiBlocks | XRB * | 318 | $2.38 | 6 | Chart | Digital currency with instant transaction and low energy use |

| 50 | Aeternity | AE * | 308 | $1.32 | 6 | Chart | A competitor to Ethereum? |

Before we buy any coin, here are some questions to ask:

- What is unique about this coin?

- What is the practice use of this coin?

- Do we think the business plan will work?

- How many coins will be produced?

- How many coins are issued?

- How will future coins be produced?

- How are coins distributed?

- How are coins used in the ecosystem?

- Why will this coin appreciate?

- Who are in the development team?

- Is the development team actively on Github?

Needless to say, almost all exchanges are open 24-7, and have a T+0 system.

Buying Blockchain Stocks

If you and I establish a shell company “Airport Blockchain LLC,” copy a white paper from one of the existing 1,360 coins, and issue stock on the OTC market, our market capitalization would be between $10 million and $100 million.

This is exactly the situation at the OTC market today. Because commercial use of blockchain technology is still in early development stage, and there are so few stocks to invest in, retail investors are chasing after every news release remotely related to blockchain. There are three types of coin stocks:

- Technology firms. Currently Overstock.com seems to be the only major player specializing in blockchain technology and its stock increased from $25 in September to $70 today. BiOptix Diagnostics, Inc., with prior business in animal healthcare and veterinary products, saw their share prices tripled in the last two months after renaming itself to Riot Blockchain Inc. It has a market capitalization of $279 million, and a revenue of $24,175 in the quarter ended September 30, 2017

- Mining and hardwire companies. After the initial distribution, many coins can continue to be mined by using computers to solve a mathematic problem. However, in order to have a better chance in mining coins, we need computers with multiple graphic processing units (GPUs). Therefore, NVIDIA Corporation has benefited tremendously from the blockchain trend.

- Other supporting companies, such as mining software developers, blockchain consulting firms, app developers, and related hardware manufacturers.

The following list is an incomplete list of companies claiming that they are working on blockchain related issues. Many stocks are traded on the OTC market and may be scams.

ADAC, APTY, BKLLF, BLKCF, BRSE, BTCS, BTSC, CDTAF, CGUD, DGGXF, DIGAF, DNAX, ENVV, EPAZ, FVRD, GAHC, GBTC, GHHC, GLNNF, IFXY, IMMD, INOTF, INTV, MARA, MGTI, NVTQF, OSTK, PRELF, RIOT, SANP, SING, SSC, SWRM, UBIA, UNSI, USTC, VSQTF, WRIT

Conclusion

This demonstrates someone’s strong ability in doing research on ambiguous topics, and judging by articles he wrote, he knows way more about airport finance than cryptocurrencies. When you get rich by joining in the coin movement, consider hiring him as your airport financial consultant.

Happy holidays to all!